26 Mar What Does It Mean When You Lose Money in the Stock Market?

Written by: Kristi Sullivan, a Certified Financial Planner™ at Sullivan Financial Planning, LLC

So, you’ve seen all the newsletters advising you not to panic and sell as the stock market loses 20% in a week. You may even hear investment folks encouraging you to buy stocks if you have any cash. But, as you watch your accounts drop each day, you can’t help feeling like buying more and seeing balances go down more is just throwing your money away.

I’d like to try to put losing money in the stock market into perspective. Consider the 3 top holdings in the Standard and Poor’s 500: Microsoft, Apple, and Amazon. If you hold any mutual funds invested in the US Large Company area of the stock market, you own these companies. And their stock prices are WAY down since the coronavirus panic started.

Try to remember, whatever the price is today, you are still an owner of Microsoft, Apple, and Amazon.

Maybe a visual aid will put it in perspective

At $190/share, you owned the company that makes and sells these:

And at $153/share, you STILL own the company that makes and sells these:

Yes, it’s 20% down in price, but you are still an owner of Microsoft. Unless, of course, you sell your stock holdings because they are down. Then you own this:

And when the maker and seller of

starts recovering from whatever slump it’s in, you will make

on your investments.

What I am trying to express is that the stock market is not this meaningless number applied to your hard-earned savings to send the values up and down at random. The stock market is made up of real, tangible companies that will continue to produce real goods and services through bad times and good.

Does it always come out positive? No! If you held K-Mart stock for the last 40 years, your K-Mart stock did well for some decades and eventually became worthless as the company was unable to keep customers and went out of business. Did the Dot Com bust or Great Recession cause that? No, more like bad management and changing customer tastes.

Here’s another example

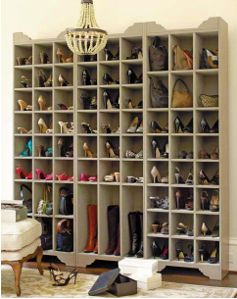

To explain the concept of buying more stocks when your account balances are down, here is my fantasy shoe wardrobe. Value when new, $10,000. Value today, $5,000 due to wear and tear and changing shoe trends.

Am I going to sell all my shoes because the price to sell them dropped? Of course not. Those shoes still have value. In fact, if I see this sign…

…you bet, I’m going out to buy more of those beautiful shoes. In fact, I may even be able to buy 2 pairs for the price I normally would pay for one. This lovely sale is enabling me to increase my shoe collection for less money.

This is what investment nerds are trying to say when they suggest buying more stocks when the market is down. It’s an opportunity to scoop up Microsoft and Apple and Amazon at something like the Nordstrom Anniversary sale.

This is not the blog that tells you we aren’t going into a recession (who knows) or that coronavirus is no big deal (I’m writing this wearing a surgical mask – kidding!). I just wanted to remind you that the stock market is made up or real companies making stuff and services you use every day. And, with a few exceptions (no, I don’t know what they are so don’t ask), these companies you own within your mutual funds will continue to produce goods and services through many recessions and expansions.

Just like you don’t throw your shoes in the trash because you couldn’t sell them for what you paid, don’t overreact to the stock market going down in value.

Similar Posts You May Like To Read:

- Can You Really Shop for Your Health Care? New Self-Service Cost Estimator Tools Introduced

- One Defensive Strategy Against Surprise Medical Bills: Set Your Own Terms

- Are You Eligible for the $1,200 COVID-19 Economic Impact Payment?

- Comprehensive Updates on Financial & Insurance Resources During Covid-19

- Help with Prescription Drug Costs: PAN Foundation Supports Cancer Patients

- Using Online Crowdfunding to Raise Financial Help for Cancer Care

- Lifeline: A Free Government Cell Phone Assistance Program

- Stimulus Payments, Health Insurance, & Returning to Work During COVID-19