15 Mar Can a Health Savings Account (HSA) Help You?

Health Savings Accounts (HSA) are designed to help people save for future medical expenses. An HSA can be used to pay for medical expenses now or to save money for medical expenses you may have in the future. However, HSAs are only available to individuals who are enrolled in a High Deductible Health Plan.

What is a High Deductible Health Plan?

A high deductible health plan (HDHP) is a plan that has a certain high deductible. The deductible is the amount you have to pay out-of-pocket, each year, before your health insurance policy kicks in. This fixed dollar amount could be $800 or $8,000. Some plans have a $0 deductible.

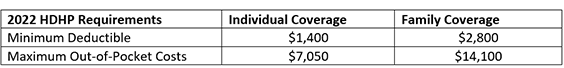

Each year, the IRS defines which health insurance plans qualify as HDHPs.

Individuals who have a HDHP are eligible to set up a Health Savings Account (HSA) through a bank or other financial institution. Your employer may also offer you an HSA account.

What is a Health Savings Account (HSA)?

An HSA is a special type of savings account that allows people to save for certain medical expenses. You can access an HSA offered through an employer or you can set it up yourself with a bank.

HSA contributions are often made pre-tax, meaning that you do not pay income taxes on the portion of your paycheck that you put into an HSA, each year.

In 2022, you can put up to $3,650 of pre-tax income into an HSA for yourself, or up to $7,300 for your family. If you are 55 or older, you can contribute an additional $1,000, each year.

HSAs are a helpful savings tool because they have triple tax advantages. You are not taxed on:

- the income that you put into an HSA in a given year.

- interest or other earnings from your HSA.

- money you take out of your HSA to use for qualified medical expenses.

What counts as a qualified medical expense is determined by the IRS, and includes most medical, dental, vision, and prescription costs.

Basically, the government tries to encourage Americans to save for health-related expenses by not taxing the money you put into or take out of an HSA.

An HSA is portable – it will stay with you if you change employers or retire. An HSA is not a “use it or lose it” savings account. Unspent contributions in your HSA rollover at the end of the year.

There are no minimum withdrawal amounts with an HSA. You can use as much or as little of the funds in your account to pay for expenses.

How do I qualify for a health savings account?

In order to enroll in an HSA, you must:

- Have a High-Deductible Health Plan (HDHP);

- Not be enrolled in Medicare; and

- Not be claimed as a dependent on someone else’s tax return.

How do I make HSA contributions?

Anyone may contribute to your HSA, including your employer or relatives. However, employer contributions are not considered income and will not be taxed.

The IRS sets a contribution limit each year. In 2022, the annual contribution limit is $3,650 for individuals and $7,300 for family coverage. If you are aged 55 or older, by the end of 2022, you are allowed to make an additional $1,000 “catch up” contribution by the end of the tax year.

Contributions from employers or relatives count towards your annual HSA limit. If you contribute more than this IRS limit, you must pay a 6% tax on contributions over the limit. You are allowed to have multiple HSAs at once, but the annual IRS limits apply to all of your accounts combined.

Using an HSA for Medical Expenses

You don't have to pay taxes on any funds in your HSA that you use to pay for qualified medical expenses, regardless of your age. HSA funds can be used to pay for your out-of-pocket medical expenses such as deductibles, co-payments, co-insurance, and other qualified expenses.

Qualified medical expenses include a wide range of medical, dental, vision, and prescription expenses. The IRS decides what types of medical expenses are considered qualified medical expenses.

The IRS may change which expenses qualify and which do not at any time. For example, the CARES Act in 2020, expanded “qualified” coverage to include certain over-the-counter medications without a prescription.

Your health plan’s sponsor may also designate what types of medical expenses are considered “qualified.” It is always recommended that you check whether a medical service is qualified before trying to use your HSA funds to pay for it.

HSA funds can only cover the cost of qualified medical expenses that you incur after you establish your HSA. You cannot use HSA funds to pay for medical expenses, that occurred before you set up your HSA.

Generally, an HSA may not be used to pay premiums. Exceptions to this rule include premiums for:

- Long-term care insurance.

- Health care continuation coverage (such COBRA).

- Health care coverage while receiving unemployment compensation under federal or state law.

- Medicare and other health care coverage, if you are 65 or older (other than premiums for a Medicare supplemental policy, such as Medigap).

Using a Health Savings Account for Non-Medical Expenses

You can use the funds in your HSA to pay for non-medical expenses or medical expenses that are not qualified by the IRS. However, if you are under age 65, you will have to pay income taxes on the funds you use for non-qualified medical expenses and an additional 20% tax penalty.

After age 65, you can use your HSA for non-medical expenses without incurring a penalty, but you will still pay income taxes on the funds.

What Happens to My HSA If I Enroll in Medicare?

While you can no longer contribute to an HSA once you enroll in Medicare, the money in your account does not disappear. You can continue to use money from your HSA to cover qualified medical expenses as you did before enrolling in Medicare.

Plus, you can use your HSA funds to pay for or reimburse yourself for premiums for Medicare parts A, B, C, and D. Premiums for Medigap or other Medicare supplement policies are not considered qualified medical expenses for using HSA funds.

Even if your Medicare premiums are deducted directly from Social Security benefits, you can still pay yourself back for the cost, by withdrawing the same amount of money from your HSA tax-free.

Is a High Deductible Health Plan with an HSA Right for You?

It is important to pick a health insurance plan that works best for you, depending on your own personal situation. Here are a few key things to consider when picking a health insurance plan:

- What will the plan actually cost me?

- Are my health care providers and facilities included in the plan’s network?

- Does the plan cover my prescription drugs and any pharmacies I use?

When comparing plans, it can be tempting to just choose the one with the lowest monthly premium. But, to figure out the total cost for the year, including your out-of-pocket expenses, you have to do some math:

(Plan’s monthly premium x 12 months) + Plan’s out-of-pocket maximum = Total annual cost

Once you have done the math, then you can decide if you have the money to put into an HSA to help cover the plan’s out-of-pocket costs for the year. Triage Cancer has a helpful worksheet to help you compare plans.

For more information about your health insurance options and how to pick a health insurance plan, visit: TriageCancer.org/HealthInsurance.

About Triage Cancer

Triage Cancer is a national, nonprofit providing free education to people diagnosed with cancer, caregivers, and health care professionals on cancer-related legal and practical issues. Through events, materials, and resources, Triage Cancer is dedicated to helping people move beyond diagnosis.