08 Jul Accessing Retirement Funds Early During COVID-19

Academic research has given a name to the financial burden of cancer, referred to as financial toxicity. Given that some form of financial burden often accompanies a cancer diagnosis, exacerbated now by the pandemic, retirement accounts may serve as vital financial lifelines for individuals and families impacted by cancer.

Although designed for retirement and use after the age of 59 1/2, IRAs and employer retirement plans may in fact be accessed early. Unfortunately, access to retirement funds is not always straightforward, and one must navigate a myriad of rules and exceptions to rules, while also grasping potential tax consequences and understanding the impact that distributions may have on other benefits that are being received (such as government benefits, e.g., Medicaid, SSI, etc.). Rules can vary from one retirement plan to the next, as well as between different types of IRAs. How to best access retirement money early also depends on personal circumstances.

How to Access Retirement Money Early

- Employer Retirement Plans: Before accessing money from an employer retirement plan, such as a 401(k) or 403(b), one must first understand the unique rules that govern the plan. Request a copy of the Summary Plan Description document, or a conversation with the plan administrator, to get specifics. In general, money within an employer retirement plan can be accessed only under certain conditions:

- Retirement Plan Loan: An employer retirement plan may offer the option to take a retirement plan loan (but is not required to). A retirement plan loan allows employees to take a distribution from their retirement plan account balance. The loan is nontaxable and not subject to penalties, if the plan loan rules are followed. The loan must be paid back over time, otherwise taxes and/or penalties may be owed. Plan loans cannot be taken when an employee is no longer employed by that company, and outstanding plan loans may be considered taxable when separated from an employer.

- Hardship Distribution: An employer retirement plan may offer access to retirement plan monies as a result of financial hardship (but is not required to). To be eligible for a hardship distribution, there must be an immediate and heavy financial need, and the distribution must be limited to the amount necessary. Distributions are subject to taxes and penalties, unless an exception applies.

- Separation from Employment: Separation from an employer generally allows access to the respective employer retirement plan balance. Distributions are subject to taxes and penalties, unless an exception applies.

- IRAs: Unlike an employer retirement plan, early access to IRAs (such as a Traditional IRA or Roth IRA) is more straightforward, and funds can be accessed at any time. Despite the flexibility, distributions are still subject to applicable taxes and penalties, unless an exception applies, or the distributions consist of Roth principal (Roth earnings may be subject to taxes and penalties).

Understand the Consequences of Accessing Retirement Funds Early

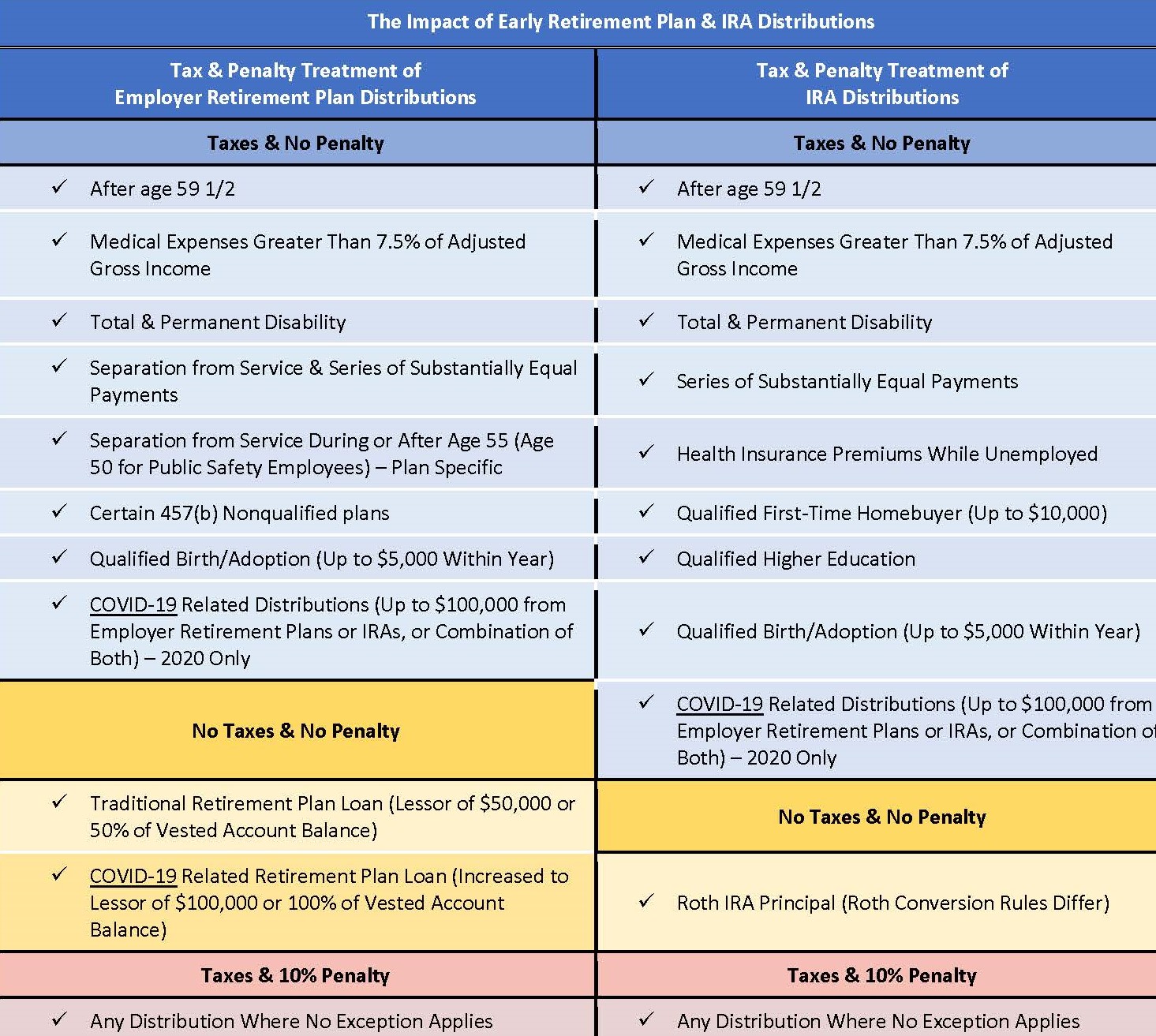

When early distributions are taken from retirement accounts, they are generally subject to taxes as well as additional penalties (typically a 10% penalty). The combination of both may take a heavy toll on retirement balances. Before taking an early distribution, it’s important to understand the tax consequences, as well as the impact of the distribution upon your overall financial plan and financial resources. Also, it is important to be aware that certain early distributions may qualify for a penalty exception if conditions are met (see attached table for examples of key penalty exceptions).

COVID-19 Relief

New in 2020, the government drafted the Coronavirus Aid, Relief, and Economic Security (CARES) Act to provide relief from the economic damage that accompanies the threat to public health, including a waiver of early withdrawal penalties and special tax treatment for retirement plan Coronavirus Related Distributions, and enhancement to employer retirement plan loans for individuals impacted by Coronavirus. Coronavirus Related Distributions may be taken for a variety of reasons, and may include an individual, spouse, or dependent diagnosis of Coronavirus, financial consequences due to the Coronavirus, the inability to work due to a lack of childcare as a result of the disease, etc. Eligibility is broad; however, individual circumstances should be confirmed with a qualified tax professional.

Identify a Suitable Investment Strategy

Before taking early distributions from a retirement plan, it is essential to also review your current investment strategy. For some people, previous investment strategies may no longer be appropriate. If early withdrawals are needed for current expenses, it may make sense to consider less aggressive and less volatile investment strategies going forward. Financial circumstances are unique to each individual, and pros and cons should be weighed before any changes to investment strategies to understand the potential impact on overall financial goals.

Conclusion

Early retirement plan distributions, whether from employer retirement plans or IRAs, can serve as financial lifelines for individuals or families dealing with a cancer diagnosis and facing significant financial burden. Before taking early retirement distributions, it is important to understand potential tax consequences, the impact on government benefits, and the impact on future financial goals. Collaborative work with a tax professional, attorney, and financial professional can help you understand the overall impact of early retirement plan distributions. The COVID-19 pandemic has also led to fluid and rapidly changing events. Staying up to date regarding potential relief measures is critical during these unprecedented times.

Source: IRS – Exceptions to Tax on Early Distributions. For a complete list of exceptions to tax on early distributions please see IRS Retirement Topics – Exceptions to Tax on Early Distributions at https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions.

Disclosure: Rules for employer retirement plans can differ from plan to plan. Check with your plan administrator to identify the rules specific to your employer retirement plan. Work with a trusted tax, legal and financial professional to understand the impact of retirement plan or IRA distributions on your financial situation.

JAY A. NEARY, CFP®, IS A FINANCIAL CONSULTANT WITH SVA WEALTH MANAGEMENT.