25 Aug Working While Retired: What You Need to Know About Social Security

There are many reasons to continue or go back to work after you have retired: it can generate extra income, fulfill purpose, add structure to your day, create opportunities for socializing with coworkers, and sharpen valuable skills. Working can add to both your daily routine and to your retirement savings.

However, the rules about working while receiving Social Security retirement benefits can be confusing.

Withheld Benefits & Taxes

It’s possible your Social Security retirement income may be taxed or your benefits may be withheld. There are also earned income thresholds you should be aware of, before you exceed that limit and get taxed unknowingly.

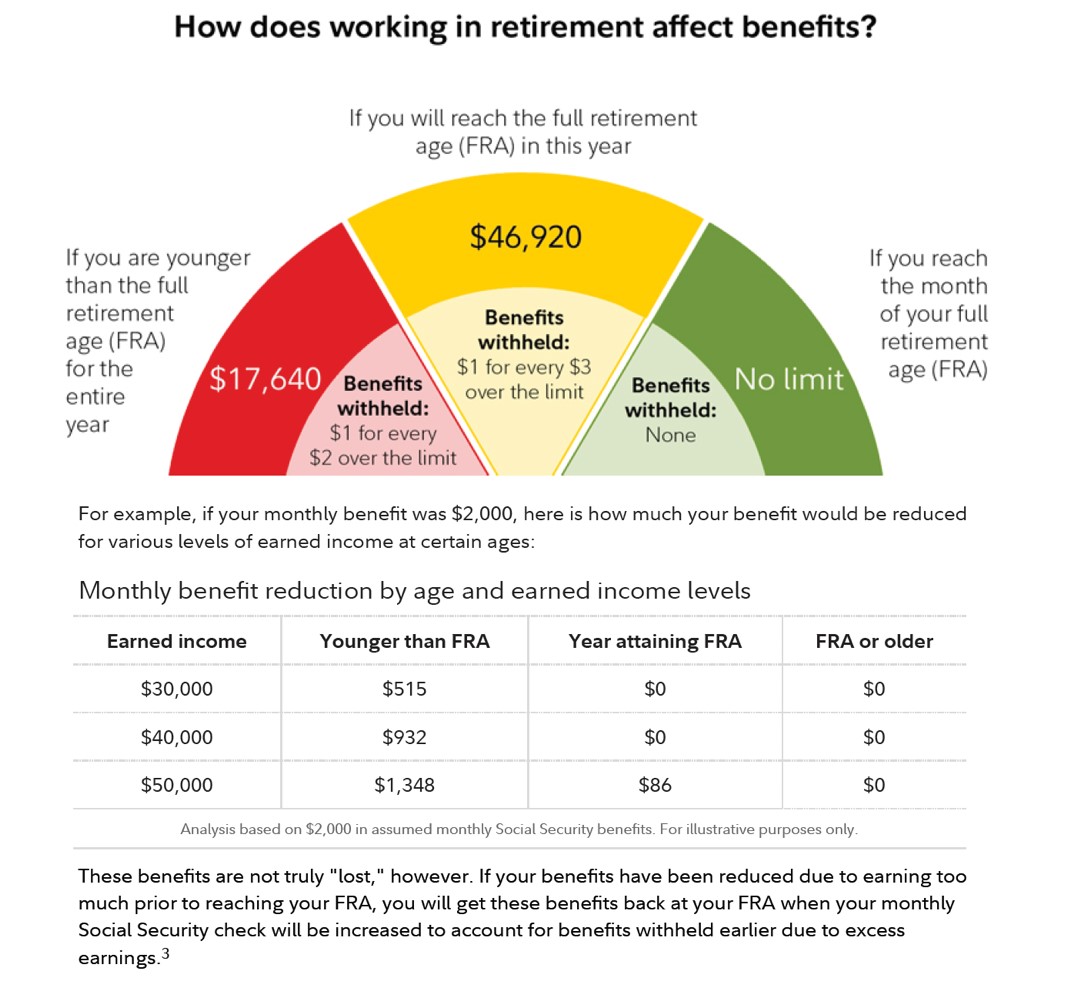

Here are the benefits withheld according to your full retirement age (FRA):

- If you’re younger than your full retirement age (FRA): $1 for every $2 earned over the annual limit of $17,640

- If you reach your FRA in this year: $1 for every $3 over the annual limit of $46,920

- Here’s when your benefits are taxed:

Once you reach the month in which you turn the FRA: No benefits withheld

If you are filing as an individual, up to 50% of your Social Security retirement benefits can be taxed, if your combined household income is between $25,000 and $34,000. If your income exceeds $34,000, up to 85% of your benefit can be taxed.

If your tax filing status is “joint,” 50% of your Social Security retirement benefits may be subject to federal income taxes, if your combined household income is between $32,000 to $44,000. 85% of your Social Security retirement benefits may be taxed If your combined income is more than $44,000.

Here’s how you calculate your “combined income:”

Adjusted Gross Income + Non-Taxable Interest + Half Social Security Benefits = Combined Income

Can I be taxed more than 85%?

The short answer: No. No more than 85% of your Social Security retirement benefits can be taxed at the federal level, no matter your income amount.

Does my state tax Social Security retirement benefits?

These thirteen states tax Social Security retirement benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia. Check with your state’s tax agency for details.

What about Social Security and Medicare taxes?

Wages earned in retirement are subject to Social Security and Medicare taxes, regardless of age or benefit status. However, these earnings can count towards the calculation of your benefits, possibly increasing your benefit.

Can earning less in retirement lower your benefits?

Though retirement earnings can increase your benefits, they cannot lower them: benefits are calculated based on your highest 35 years of earnings, no matter what. If wages earned post-retirement are lower than those earned before you are tired, this will have no impact on the calculation of your benefit.

Still have questions?

Visit our Employment page for more Social Security resources, or check out these resources from the Social Security Administration.

- How Work Affects Your Benefits

- Benefits Planner: Retirement

- Your Options: Working, Applying for Retirement, or Both?