02 Aug Buyer Beware: New Rule for Short-Term Health Insurance Plans

A new federal rule released yesterday will make it harder for advocates and health care professionals who work every day to help people with pre-existing conditions (e.g., cancer, high blood pressure, allergies, high cholesterol, etc.), access quality care and adequate health insurance coverage.

The U.S. Departments of Health and Human Services, Labor, and the Treasury released a final rule that allows the increased sale of short-term health insurance plans. The new rule allow plans to be sold for up to 364 days. If they last 365 days, then they have to comply with the consumer protections provided for in the ACA, like protections for people with pre-existing conditions. The ACA had limited the sale of these plans to 3 months, with the goal of eliminating them entirely to move people towards more comprehensive coverage. The rule also allows these plans to be renewed for up to 36 months. The rule goes into effect in 60 days.

We have previously shared the dangers of short-term health insurance plans, which are also reference to as “junk insurance.”

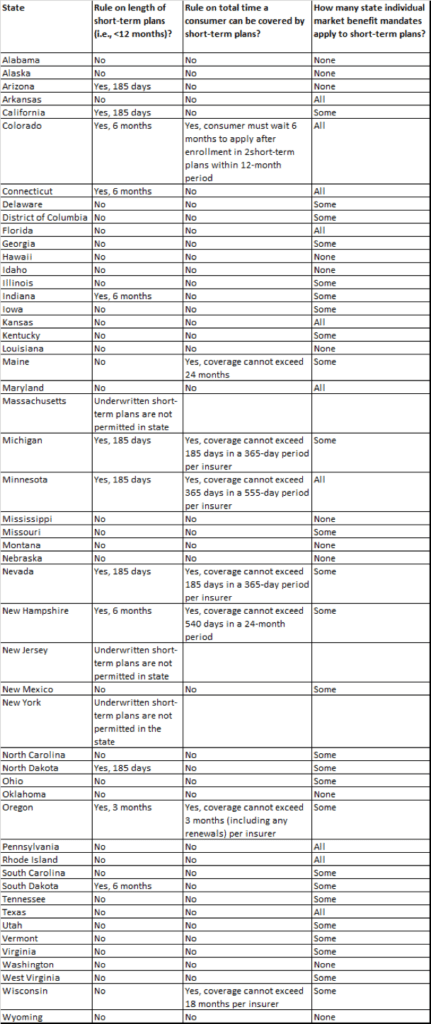

Source: www.commonwealthfund.org

We do not deny that these plans might be a useful option to help bridge a gap or provide a basic level of coverage for individuals who do not have medical needs. The problem is that these plans are deceptive. Consumers don’t understand that these plans can:

- Deny them based on their pre-existing condition

- Charge people with pre-existing conditions more for their plan

- Impose pre-existing condition exclusion periods where they won’t cover any care related to a pre-existing condition

- Impose annual or lifetime caps on coverage

- Exclude entire categories of care (e.g., prescription drugs, chemotherapy, pregnancy, mental health care, etc.)

- Avoid having an out-of-pocket maximum, which means higher out-of-pocket costs for consumers

- Spend less than 80% of your premiums on your actual medical care (the ACA set a minimum of 80% or insurers would have to refund you a portion of your premiums)

So, consumers buy these plans because they appear to be cheap, but are unaware of the pitfalls of these plans.

A Kaiser Family Foundation analysis of 24 short-term plans sold in 45 states found:

- None covered maternity care;

- 71% did not cover outpatient prescription drugs;

- 62% did not cover substance abuse treatment; and

- 43% did not cover mental health services.

Some states have taken steps to prevent these plans from being sold in those states. For example, in California, a bill that would prohibit the sale of short-term plans, by state Sen. Ed Hernandez (D-West Covina), has already passed the California Senate and is pending in the Assembly, where two committees have already approved it. Other states are now considering how to protect consumers from the dangers of these plans. Some states have existing laws related to these plans that existed prior to the ACA and will go back into effect with this new federal rule.

Even health insurance companies have warned that the sale of these plans will drive up prices an average of 5% for individual health insurance plans being sold in the state marketplaces. While HHS estimates that an additional 200,000 will have access to coverage because of this new option, it is also estimated to actually end up costing the federal government $28 billion over 10 years.

For our policy wonk followers, here is an image which breaks down how HHS thinks people will move towards these plans:

Ultimately, we want consumers to make educated decisions and not get caught off-guard by one of these plans. So, buyer beware.