29 Apr Managing Work, Taking Time Off, & Unemployment During COVID-19

During this unprecedented time, there are a lot of changes at the federal and state levels to help people manage their finances, work, and insurance. We will continue to share information on our blog about the details about these programs, as more information is released, including federal regulations.

Please note that this information is changing frequently, so please make sure to get the latest information directly from these resources.

This blog will focus on changes that may be helpful to you in the areas of work, specifically, paid sick leave, and paid family leave, and new unemployment benefits. Stay tuned for an additional blog post explaining options for requesting ADA reasonable accommodations or regular FMLA leave and how those laws work with these new options.

Over the last seven weeks, Congress has passed 4 COVID-19 response bills:

3/6/20: Coronavirus Preparedness and Response Supplemental Appropriations Act (HR 6074)

3/18/20: Families First Coronavirus Response Act (HR 6201)

- Emergency Paid Sick Leave Act (EPSLA)

- Emergency Family & Medical Leave Expansion Act (EFMLEA)

3/27/20: Coronavirus Aid, Relief, and Economic Security (CARES) Act (HR 748)

- Unemployment Benefits

- Economic Impact Payments

4/24/20: Paycheck Protection Program and Health Care Enhancement Act (HR 266)

This blog is going to focus on the employment changes in the second and third bill.

When Congress passes a law, it generally provides the framework for that law. But it relies on the relevant federal agencies, or state governments to fill in the details about how the law gets implemented. For example, with the FFCRA and the CARES Act, the U.S. Department of Labor and the IRS are just two of the federal agencies responsible for filling in those details. And, the way that they do that is by issuing regulations and providing guidance that is often in the form of FAQs. There are also things that states and individual employers have to do, as well.

So all of that to say, a lot has happened in the last few weeks, and things have changed over and over again. It is important to realize that they still might be changing, but this the information that we have today.

Emergency Paid Sick Leave Act (EPSLA)

Effective: 4/1/20-12/31/20

What is it?

If an employee is unable to work, or telework, due to one of six possible reasons, then they are eligible for paid sick leave:

- Full-time employees = eligible for up to 80 hours, based on their regular schedule

- Part-time employees = eligible for the number of hours they work, on average, over 2-week period

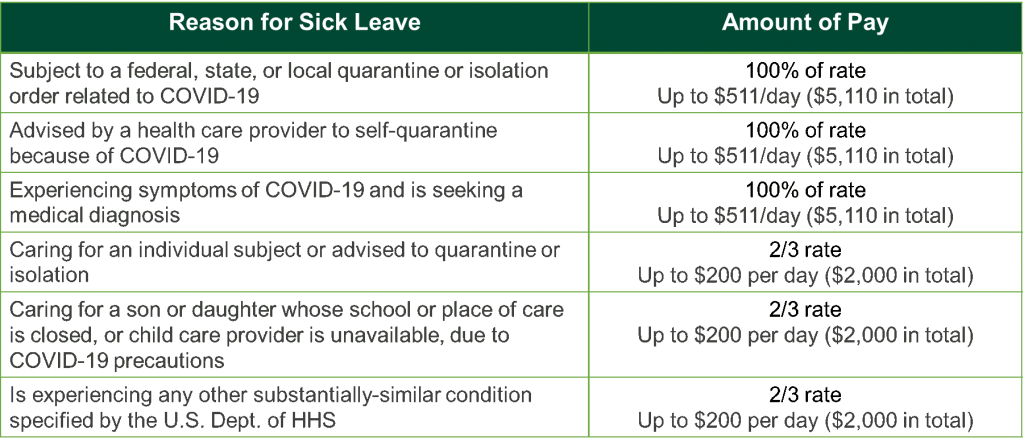

Employees are eligible for the continuation of their health insurance coverage during the paid sick leave period, if they receive coverage through their employer. The amount that an employee gets paid while on paid sick leave depends on the reason that they are taking sick leave. See the chart below:

Note: Generally, being “advised by a health care provider to self-quarantine because of COVID-19,” refers to someone who has been exposed to COVID-19 and should self-quarantine to avoid exposing others. It does not refer to someone with a compromised immune system who is concerned about being exposed to COVID-19 and wants to self-quarantine.

Who Qualifies?

Employees who work for private employers with less than 500 employees, and employees who work for the government and schools. Federal employees are eligible, but the OMB has the authority to exclude certain employees. When an employee requests leave is the moment that the employer has to count how many employees work for the employer to see if they are required to provide paid sick leave.

Only one family member can take paid sick leave at a time as a caregiver.

Private employers with less than 50 employees can apply for an exemption from having to provide the paid sick leave, if the employee’s leave is to care for a child whose school or child care location is closed and it would jeopardize the viability of the business.

Employers may exclude “health care providers” or “emergency responders” from accessing paid sick leave.

Who is a Health Care Provider?

Anyone employed at any doctor’s office, hospital, health care center, clinic, post-secondary educational institutional offering health care instruction, medical school, local health department or agency, nursing facility, retirement facility, nursing home, home health provider, any facility that performs laboratory or medical testing, pharmacy, OR any similar institution, employer, or entity

Who is an Emergency Responder?

Anyone necessary for transport, care, health care, comfort and nutrition of such patients, or others needed for the response to COVID-19.

- Includes military or national guard, law enforcement officers, correctional institution personnel, fire fighters, emergency medical services professionals, physicians, nurses, public health personnel, emergency medical technicians, paramedics, emergency management personnel, 911 operators, public works personnel, and person with skills or training in operating specialized equipment or other skills needed to provide aid in a declared emergency, as well as individuals who work for such facilities employing these individuals and whose work is necessary to maintain the operation of the facility.

How Does Paid Sick Leave Works with Other Laws?

Employees can choose to use paid sick leave before any accrued leave available. Employees cannot be required to use their accrued leave first before using paid sick leave. The new paid sick leave benefit is in in addition to other paid sick leave or paid time off (PTO) offered by the employer or required under state or local laws.

This new paid sick leave benefit can be used for pay during first two weeks of unpaid FMLA leave under the new Emergency Family & Medical Leave Expansion Act (EFMLEA).

Unlike the regular FMLA, paid sick leave must be taken in full day increments.

If an employer closes the business, then paid sick leave is not an option, but an employee could apply for unemployment benefits (see below).

If an employee is on paid sick leave, and the employer closes the business, then the paid sick leave would end and the employee could apply for unemployment benefits.

Emergency Family & Medical Leave Expansion Act (EFMLEA)

Effective: 4/1/20-12/31/20

What is it?

An employee who is unable to work, or telework, because of a need to care for a minor child, whose school or place of child care has closed (or if the child care provider is unavailable) due to COVID-19, is eligible for:

- Up to 12 weeks of job-protected and health insurance protected leave

- First two weeks unpaid

- But can substitute accrued leave or use paid sick leave under the EPSLA

- Next 10 weeks paid at 2/3 employee’s regular rate of pay

- Capped at $200 / day or $10,000 total

Note: this is a new leave reason under the original FMLA. It does not entitle an employee to additional weeks beyond the original FMLA.

Who Qualifies?

Employees who’ve worked for at least 30 days for a private employer with less than 500 employees, or for the government or schools. Some federal employees are eligible, but the OMB has the authority to exclude certain employees. When an employee requests leave is the moment that the employer has to count how many employees work for the employer to see if they are required to provide paid sick FMLA leave.

Only one family member can take paid FMLA leave at a time as a caregiver.

Private employers with less than 50 employees can apply for an exemption from having to provide the paid FMLA leave, if the employee’s leave is to care for a child whose school or child care location is closed and it would jeopardize the viability of the business.

Employers may exclude “health care providers” or “emergency responders” from accessing paid sick leave. See above for definitions of who these employees are.

Comparison of Covered Employees:

What Documentation is Needed to Take Paid Sick Leave & Paid FMLA Leave?

Employees must provide, orally or in writing:

- Name

- Date(s) for which you request leave

- The reason for leave; and

- A statement that you are unable to work because of the above reason

- If requesting leave due to a quarantine or isolation order, provide the name of the government entity that issued the order

- If requesting leave based on the advice of a health care provider or caring for an individual who is self-quarantining based on such advice, provide the name of the provider

- If requesting leave to care for child whose school or childcare is closed, provide the name of child, name of school or child care provider, a statement that no other suitable person is available to care for your child

How are States Providing Additional Benefits?

It is important to understand that some states had existing protections beyond what federal law provides, and that some states are taking additional steps to provide benefits during this time. For example:

CA Governor Newsom’s Executive Order N-51-20 on 4/16

This Executive Order provides food sector workers up to 80 hours of COVID-19 Supplemental Paid Sick Leave, if they are unable to work because they are:

- Subject to a federal, state, or local quarantine or isolation order

- Advised by a health care provider to self-quarantine or self-isolate due to concerns related to COVID-19

- Prohibited from working by the employer due to health concerns related to the potential transmission of COVID-19

This Executive Order helps employees who are not protected under the new federal paid sick leave law because they work for a private employer with more than 500 employees.

For information about what is available in your state, visit https://TriageCancer.org/StateResources and https://TriageCancer.org/StateLaws.

Unemployment Benefits:

Each state provides unemployment benefits for eligible employees. For information about each state’s programs, visit: https://TriageCancer.org/StateResources and https://triagecancer.org/state-laws/employment-rights.

Under the CARES Act, Congress provided new federal unemployment benefits (Federal Pandemic Unemployment Compensation). FPUC:

- Expands Amount:

- Provides an extra $600 per week, on top of the state’s maximum benefit, for a total of 4 months until 7/31/20. States can add the additional $600 to your regular unemployment benefits check or provide a separate check each week. Part-time workers are also eligible for the additional $600, but the state benefit amounts and length of benefits depends on the state.

- Expands Length:

- Provides an extra 13 weeks of benefits, for a total of 39 weeks maximum (most states previously offered 26 weeks of benefits). States are also receiving financial incentives from the federal government to eliminate their regular 7-day waiting period for benefits.

- Expands Coverage:

- Provides benefits to self-employed freelancers, independent contractors, and gig workers, who have previously been ineligible for unemployment benefits.

Who is Eligible for New Unemployment Benefits?

- If lost employment

- If unemployed, partly unemployed, or cannot work because your employer closed down

- If unemployed, partly unemployed, or cannot work due to receiving a diagnosis of Covid-19, are experiencing symptoms, or are seeking a diagnosis

- If you care for a member of your family or household who has received a diagnosis

- If you rely on a school, day care, or other facility to care for a child, elderly parent, or another household member so that you can work and that facility is closed due to Covid-19

- If you must self-quarantine

- If unable to get to work because of a quarantine

- If the spouse of the breadwinner of a household, who dies as a result of Covid-19

- But not if you quit because you fear contracting Covid-19

Other Important Details?

- Expanded coverage is available for weeks starting 1/27/20, through 12/31/20.

- Even if you are currently receiving unemployment benefits, you can now can get the 13-week extension and the additional $600 per week.

- If you have exhausted unemployment benefits in your state recently, you can reapply to get access to these new benefits, but the details vary by state

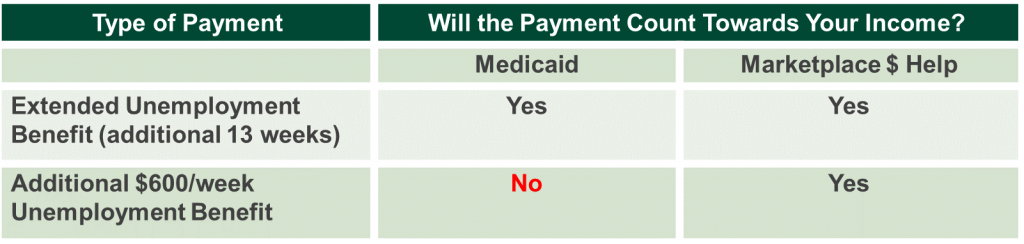

How do the additional unemployment benefits affect your income eligibility for health insurance?

Learn More or File for Unemployment Here.

If you have lost your health insurance coverage or are uninsured, watch our recent webinar Key Changes to Insurance, Finances, & Work During COVID-19 and visit https://TriageCancer.org/HealthInsurance.

Stay tuned for additional updates from Triage Cancer . . .