Considerations for Picking a Medicare Plan

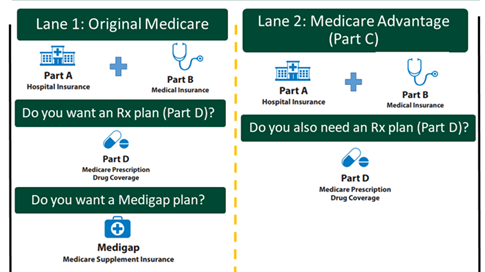

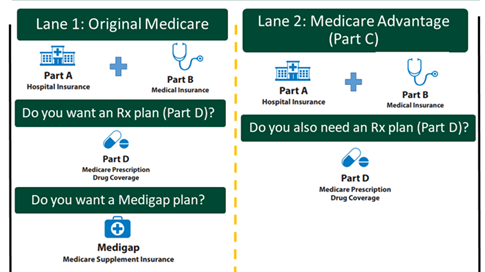

Finding the right Medicare plan can feel overwhelming. There are generally 2 lanes to choose from:

- Original Medicare with Parts A and B, plus you can choose a Part D plan, and you can choose a Medigap plan.

- Medicare Advantage plan that includes the benefits of Parts A and B, and usually Part D. If the Advantage plan does not include Part D, then you can also choose a Part D plan.

There are a few key things to consider when picking a Medicare plan:

- What will the Medicare plan actually cost me?

- Do my health care providers and facilities take Medicare, and if I choose a Medicare Advantage plan, are they in the plan’s network of providers?

- Does the Part C or Part D plan cover my prescription drugs and pharmacies I use?

When comparing plans, it can be tempting to just choose the one with the lowest monthly premium. But, to figure out the total cost for the year, including your out-of-pocket expenses, you have to do some math:

(Plan’s monthly premium x 12 months) + Plan’s out-of-pocket maximum = Total annual cost

Picking a Plan Example

Jamie: Jamie is nearly 65 years old and is about to begin 1 year of IV chemotherapy treatments, which will cost $10,000 a month. Because the IV treatment will be provided in the doctor’s office, it will be covered under Medicare Part B. What would be her out-of-pocket costs?

Option 1: Original Medicare

- Part B monthly premium = $202.90 per month x 12 = $2,434.80

- Part B deductible = $283

- Part B co-insurance (just for her chemo) = ($10,000 x 20% = $2,000) x 12 months = $24,000

- Total for Part B and chemo cost-share = $26,717.80

Option 2: Original Medicare + Medigap Plan G (costs $300/month based on her age and where she lives)

- Part B monthly premium = $202.90 per month x 12 = $2,434.80

- Part B deductible = $283

- Part B co-insurance (just for her chemo) = $0 (paid for by Medigap plan)

- Medigap plan G monthly premium = $300 x 12 months = $3,600

- Total for Part B + Medigap Plan G = $6,317.80. Although there’s an additional monthly cost to buy a Medigap plan, it can save someone with an expensive medical condition thousands of dollars each year.

Option 3: Medicare Advantage plan with drug coverage (costs $83/month based on where she lives). This plan has an out-of-pocket maximum of $4,758.

- Part B monthly premium = $202.90 per month x 12 = $2,434.80

- Medicare Advantage monthly premium = $83 per month x 12 = $996

- Medicare Advantage co-insurance (just for her chemo) = ($10,000 x 20% = $2,000) x 12 months = $24,000 (but she only has to pay up to her out-of-pocket maximum of $4,758)

- Total Medicare Advantage (MA) Plan and chemo cost-share = $8,188.80. Although the MA plan is less expensive than Original Medicare (Option 1), Jamie is limited to only going to in-network providers.

For more information on how to pick your Medicare plans, including Part C, Part D, and Medigap plans, visit: Medicare.gov/plan-compare

Prescription Drug Terms

There are some additional terms that are helpful to understand about prescription drug coverage:

- Brand-name drugs: a prescription drug with a specific name from the company that sells the drug. At a point in the future, usually after a patent expires, a generic version of a drug may be available and sold by other companies.

- Generic drugs: a prescription drug that contains the same chemical substance as a brand-name drug.

- Specialty drugs: prescription drugs that have a high cost, high complexity, and/or require a high touch. Many drugs for cancer are considered specialty drugs.

- Formulary: a list of prescription drugs that a health plan will cover and for how much. Understanding and using a plan's formulary will help you save money on medications. Some plans have formularies with two or more cost levels, known as tiers. A drug on a higher tier will have higher out-of-pocket costs for you. The highest tier in most formularies is the “specialty” tier, which includes many cancer drugs. The co-payment and co-insurance amounts will depend on the tier of the drug you are taking. For example, a tier 1 drug may have a $10 co-payment, while a tier 5 specialty drug may have a 30% co-insurance amount.

- Step therapy: when an insurance company requires patients to try a generic or lower cost drug before getting a brand-name or more expensive drug. If the lower cost drug doesn't work or causes a bad reaction, the patient would be allowed to “step up” to another medicine. If your Part D plan uses step therapy, it is important to work with your health care team to show that taking a specific drug is medically necessary for you and why the insurance company should make an exception to their process.