09 Oct When Your Insurance Company Says No

Do you know what to do if your insurance company says that it will not cover the care you’re your health care team thinks you should get?

It is crucial not to take “no” for an answer. But must people do. And they either pay for their care out-of-pocket, or they don’t get the care that they need.

During time of crisis, like when an individual is dealing with a cancer diagnosis, it can be a real challenge to receive quality coverage for legitimate claims. However, we know all too well it’s never that easy.

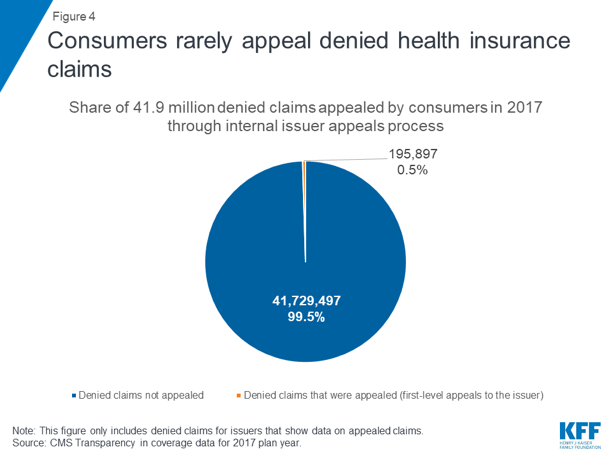

In 2017, there were 41.9 million claims were denied by insurance companies. But only .5% of those claims were appealed by customers through an insurance company’s internal appeals process.

In a Los Angeles Times article on appeals, they reference a study that “…found that when patients challenged the insurers’ denials, about half of the rejected claims ended up being covered. Think about that. Claims get rejected about half the time for dubious reasons — or, the cynic in me wants to say, because the insurer is curious to see if the patient has the wherewithal and stamina to navigate the appeals process.”

Did you know those who don’t accept the denial, and file an appeal, actually win and get coverage for the care prescribed by their health care team up to 60% of the time!

So, how do we go about understanding the appeals process?

Generally, you have two chances to appeal a denial of coverage: an internal appeal and an external appeal.

First, when an insurance company has denied coverage for care, you can file an “internal appeal” within your insurance company. Each insurance company has their own internal appeals process, so contact your insurance company for details or look for instructions on how to file an appeal on your denial letter. There are time frames related to filing an internal appeal.

Then, within 60 days after receiving your insurance company’s denial of your internal appeal, you can file an “external appeal.” External appeals must be completed within 45 days of filing and the decision is binding on the insurance company. If urgent, reviews can be expedited and decided within 72 hours.

State insurance agencies administer the external appeals process. Visit http://TriageCancer.org/StateResources to find your state insurance agency’s contact information.

In Triage Cancer’s Quick Guide to Appeals for Employer-Sponsored & Individual Health Insurance, we cover the key steps to the Appeals Process:

- Contact your insurance company: Contact the insurance company to ask for a detailed explanation of your denial and the company’s internal appeals process.

- Understand your denial: our Quick Guide covers a list of reasons why insurance companies may deny your claim

- Gather evidence: When gathering evidence for your appeal, make sure to pay attention to the deadlines and requirements for your insurance companies' internal appeals process. We provide a list of support documents you can include in your appeal in our Quick Guide.

Check out our Quick Guide for in-depth information on each of these steps, types of appeals and when you should submit an appeal, appeals before care vs. after care, and more!

For more information on health insurance and appeals:

- Triage Cancer Health Insurance Resources: http://TriageCancer.org/HealthInsurance

- Triage Cancer Webinar on Appeals: https://triagecancer.org/webinar-appeals