Quick Guide to Medicare 2026

In Triage Cancer's free Quick Guide to Medicare, learn about the parts of Medicare, 2026 costs, how a Part D plan works, Medigap plans, how to enroll, the Affordable Care Act's impact on Medicare, limits, and more!

In Triage Cancer's free Quick Guide to Medicare, learn about the parts of Medicare, 2026 costs, how a Part D plan works, Medigap plans, how to enroll, the Affordable Care Act's impact on Medicare, limits, and more!

Medicare is a government funded and run health insurance program for eligible individuals. To be eligible you must: be 65+ years old; have collected SSDI more than 24 months; or have been diagnosed with end stage renal disease (ESRD) or ALS. There are currently about 68 million Americans enrolled in Medicare.

Part A: Hospital Insurance. Includes hospital care, hospice, and limited coverage for skilled nursing facilities, nursing homes, and home health services.

Part A: Hospital Insurance. Includes hospital care, hospice, and limited coverage for skilled nursing facilities, nursing homes, and home health services.

Part B: Medical Insurance. Medical Insurance. Includes services from doctors, preventive care, outpatient care, lab tests, mental health care, ambulance services, and durable medical equipment.

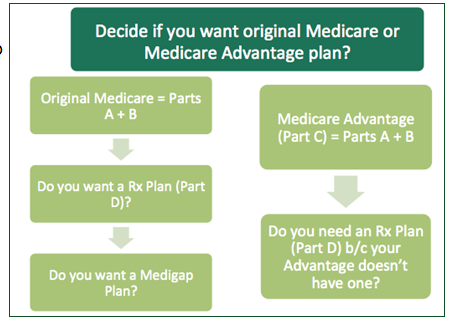

Part C: Advantage Plans. Part C is an alternative to Parts A & B and it includes the benefits and services covered under Parts A & B, and usually Part D. You can select a PPO or HMO plan that is run by a Medicare-approved private insurance company. Make sure to select a plan that covers your health care providers.

Part D: Prescription Drug Coverage. Sold by Medicare-approved private insurance companies. You have different plans to choose from depending on where you live, with different premiums and formularies. Make sure to select a plan that covers the drugs you take.

If Your Yearly Income in 2024 (for what you pay in 2026) was:

| File Individual Tax Return | File Joint Tax Return | File Married & Separate Tax Return | You Pay per Month in 2026 |

|---|---|---|---|

| $109,000 or less | $218,000 or less | $109,000 or less | $202.90 |

| above $109,000 up to $137,000 | above $218,000 up to $274,000 | Not applicable | $284.10 |

| above $137,000 up to $171,000 | above $274,000 up to $342,000 | Not applicable | $405.80 |

| above $171,000 up to $205,000 | above $342,000 up to $410,000 | Not applicable | $527.50 |

| above $205,000 and less than $500,000 | above $410,000 and less than $750,000 | above $109,000 and less than $391,000 | $649.20 |

| $500,000 or above | $750,000 or above | $391,000 and above | $689.90 |

Additional Part D Premium Costs: If your yearly income in 2024 (for what you pay in 2026) was:

| File Individual Tax Return | File Joint Tax Return | Married, File Separate Tax Returns | You Pay per Month in 2026 |

|---|---|---|---|

| $109,000 or less | $218,000 or less | $109,000 or less | $0 |

| above $109,000 up to $137,000 | above $218,000 up to $274,000 | Not applicable | $14.50 |

| above $137,000 up to $171,000 | above $274,000 up to $342,000 | Not applicable | $37.50 |

| above $171,000 up to $205,000 | above $342,000 up to $410,000 | Not applicable | $60.40 |

| above $205,000 and less than $500,000 | above $410,000 and less than $750,000 | above $109,000 and less than $391,000 | $83.30 |

| $500,000 or above | $750,000 or above | $391,000 and above | $91 |

| Prescription Drug Expenses | You Pay | Medicare Pays |

|---|---|---|

| $1-$615 | $615 deductible | $0 |

| $615-$2,100 (total out-of-pocket costs) | 25% brand name and generic | 75% brand name and generic |

| $2,100+ | $0 | 100% |

A Medigap plan is a supplemental insurance plan that will help pay for your deductibles, co-payments, and cost share amounts. Plans are labeled as A through N, and each plan with the same letter must offer the same basic benefits. The premiums and deductibles vary with each plan. If you have chosen original Medicare (Parts A & B), there is a 20% cost share amount, so a Medigap plan can help pay for that expense.

When you are first eligible for Medicare, you can make choices about your Medicare coverage during a 7-month Initial Enrollment Period (IEP). The IEP includes 3 months before the month you turn 65, the month you turn 65, and 3 months after the month you turn 65. If you do not sign up during your IEP, there is a General Enrollment Period (GEP) that runs from January 1 to March 31, but your coverage will not begin until the month after you enroll, and you may face late enrollment penalties. You can also make changes to your coverage every year during an Open Enrollment period that runs from October 15 to December 7. Changes will not begin until January 1.

| Enrollment | Period | Coverage Begins |

|---|---|---|

| Open Enrollment | 10/15 to 12/7 | January 1 |

| General Enrollment A/B | 1/1 to 3/31 | Month after you enroll |

| General Enrollment C/D | 4/1 to 6/30 | July 1 |

Medicare beneficiaries are now entitled to a free annual wellness visit, free preventive care, and lower costs for prescription drugs.

Medicare does NOT cover some services (e.g., long-term care, most dental care, eye exams related to prescription glasses, dentures, cosmetic surgery, acupuncture, hearing aids, and routine foot care. Some services may be covered by a Medicare Advantage (Part C) plan.

Last updated: 11/25

Disclaimer: This handout is intended to provide general information on the topics presented. It is provided with the understanding that Triage Cancer is not engaged in rendering any legal, medical, or professional services by its publication or distribution. Although this content was reviewed by a professional, it should not be used as a substitute for professional services. © Triage Cancer 2023

We're glad you find this resource helpful! Please feel free to share it with your communities or to post a link on your organization's website. However, this content may not be reproduced, in whole or in part, without the express permission of Triage Cancer. Please email us at info@TriageCancer.org to request permission.

This Quick Guide can be downloaded and printed for free. If you are a health care professional, we provide free, bulk copies of many of our resources. To make a request, visit TriageCancer.org/MaterialRequest.