Quick Guide to Medigap Plans

In Triage Cancer's free Quick Guide to Medigap Plans, you'll learn about the parts of Medicare, how to qualify for Medigap, when to buy a Medigap plan, and differences by state.

In Triage Cancer's free Quick Guide to Medigap Plans, you'll learn about the parts of Medicare, how to qualify for Medigap, when to buy a Medigap plan, and differences by state.

Medicare is a government-funded and run health insurance program. To be eligible for Medicare, you must: be 65+ years old; have collected SSDI more than 24 months; or have been diagnosed with end-stage renal disease (ESRD) or ALS. Medicare coverage is broken down into 4 parts:

Medigap plans are additional insurance you can purchase to help pay deductibles, co-payments, co-insurance amounts, and other expenses original Medicare does not cover. You can buy a Medigap policy from any licensed insurance company in your state. You will pay a monthly premium for a Medigap plan, in addition to the monthly premiums you already pay for other parts of Medicare. Medigap plans are standardized, meaning every insurer that offers plans lettered A-N must provide the same basic benefits listed in the chart below.

| Coverage | Plan A | Plan B | Plan C | Plan D | Plan F | Plan G | Plan K | Plan L | Plan M | Plan N |

|---|---|---|---|---|---|---|---|---|---|---|

| Medicare Part A Co-insurance & Hospital Costs (Up to an additional 365 days after Medicare benefits are used) | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

| Medicare Part B Co-insurance or Co-payments | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Blood First 3 Pints | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Part A Hospice Co-insurance or Co-payments | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Skilled Nursing Facility Co-insurance | x | x | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Medicare Part A Deducible | x | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 50% | 100% |

| Medicare Part B Deductible | x | x | 100% | x | 100% | x | x | x | x | x |

| Medicare Part B Excess Charges | x | x | x | x | 100% | 100% | x | x | x | x |

| Foreign Travel Emergency (up to plan limits) | x | x | 80% | 80% | 80% | 80% | x | x | 80% | 80% |

| Out of Pocket Maximum | $8,000 in 2026 | $4,000 in 2026 |

The percentage shown is the amount the Medigap plan covers.

Note: Individuals who became eligible for Medicare after 1/1/2020 are no longer be able to purchase Medigap Plans F or C. Any individuals who already have Plans F or C will be able to keep those plans.

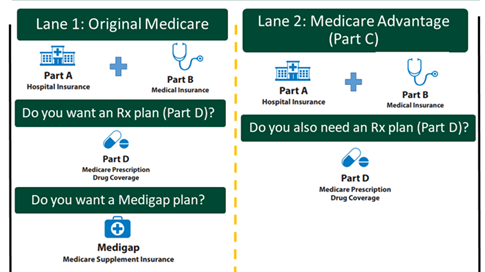

To qualify for a Medigap plan, you must be enrolled in Medicare Part A and B. Part A and B together are referred to as “Original Medicare.” For a more in-depth breakdown of Medicare Parts A and B, see our Quick Guide to Medicare Basics.

The best time to purchase a Medigap plan is during your Medigap Open Enrollment Period. This is the 6-months that begin the first day of the month you are 65 or older and you have signed up for Part B. If you enroll in a Medigap plan during the period time, you cannot be denied coverage.

If you wait to buy a plan outside of your Medigap Open Enrollment Period, and you do not have a “guaranteed issue right,” you may face a pre-existing condition exclusion period of up to 6-months, the plan may cost more, and/or you may be denied coverage. “Guaranteed Issue Rights” exist in certain limited situations (e.g., your Medicare Advantage plan is leaving Medicare or you move out of the plan's service area). For a list of these situations, visit Medicare.gov.

Once you have a Medigap plan, it is automatically eligible for renewal, regardless of any health problems. Your Medigap plan can only be canceled if you fail to pay the premiums.

If you are under 65, and have Medicare because of a disability, your state may not require insurance companies to sell you a Medigap plan. Visit TriageCancer.org/StateLaws for more information.

Part B of Medicare has a 20% co-insurance amount. Most chemotherapies are covered under Medicare Part B, which can create high out-of-pocket costs. Buying a Medigap plan that covers Part B’s 20% co-insurance can greatly reduce your out-of-pocket costs. These examples show how:

If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies are standardized in a different way. For more information visit Medicare.gov.

Last updated: 01/2026

Disclaimer: This handout is intended to provide general information on the topics presented. It is provided with the understanding that Triage Cancer is not engaged in rendering any legal, medical, or professional services by its publication or distribution. Although this content was reviewed by a professional, it should not be used as a substitute for professional services. © Triage Cancer 2026

We're glad you find this resource helpful! Please feel free to share it with your communities or to post a link on your organization's website. However, this content may not be reproduced, in whole or in part, without the express permission of Triage Cancer. Please email us at info@TriageCancer.org to request permission.

This Quick Guide can be downloaded and printed for free. If you are a health care professional, we provide free, bulk copies of many of our resources. To make a request, visit TriageCancer.org/MaterialRequest.