12 Jun A Breakdown of Medicare Savings Programs (MSP)

Medicare is a crucial program that provides health insurance coverage for seniors and people with disabilities, but the details and costs of Medicare can make your head spin. The Part B benefit (outpatient care) has a monthly premium of $134 per month for most people. Meanwhile, Part A (inpatient care) has a $1,316 deductible and Part B a $183 deductible. While those number might overwhelm you, learning about the Medicare Savings Programs might actually give you a sense of relief.

costs of Medicare can make your head spin. The Part B benefit (outpatient care) has a monthly premium of $134 per month for most people. Meanwhile, Part A (inpatient care) has a $1,316 deductible and Part B a $183 deductible. While those number might overwhelm you, learning about the Medicare Savings Programs might actually give you a sense of relief.

What are Medicare Savings Programs (MSP)?

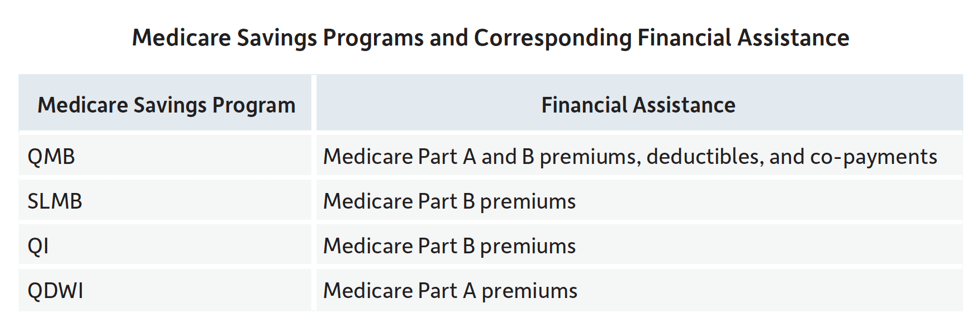

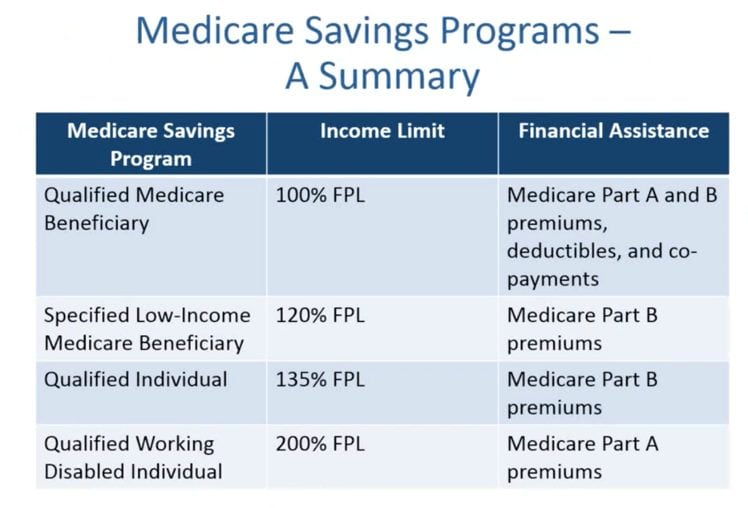

They are a category of Medicaid, the other federal health insurance program, which is run by state Medicaid agencies. Medicare Savings Programs are for individuals who have low incomes and qualify for Medicare, but can’t afford Medicare costs. There are four different Medicare Savings Programs and each program exists to fill gaps in Medicare coverage:

- Qualified Medicare Beneficiary Program (QMB)

- For individuals with the lowest income levels

- Specified Low-Income Medicare Beneficiary Program (SLMB)

- Qualified Individual Program (QI)

- Qualified Disabled Working Individual Program (QDWI)

*It’s important to note that your state might have a different name for each program.

Qualified Medicare Beneficiary (QMB) Program:1

- Beneficiary must be receiving Medicare Part A

- Individual Monthly Income Limit: $1,032

- Married Couple Monthly Income Limit: $1,392

- Resource (asset) Limit: $7,560/single or $11,340/couple

- Program Covers: Part A and Part B premiums, and other cost-sharing (like deductibles, coinsurance, and copayments)

Specified Low-Income Medicare Beneficiary (SLMB):

- Beneficiary must be receiving Medicare Part A

- Individual Monthly Income Limit: $1,234

- Married Couple Monthly Income Limit: $1,666

- Resource (asset) Limit: $7,560/single or $11,340/couple

- Program Covers: Part B premiums only

Qualifying Individual (QI):

- Beneficiary must be receiving Medicare Part A

- Individual Monthly Income Limit: $1,386

- Married Couple Monthly Income Limit: $1,872

- Resource (asset) Limit: $7,560/single or $11,340/couple

- Program Covers: Part B premiums only

Qualified Disabled & Working Individuals (QDWI):

- Beneficiary must have a disability, be under age 65, and on SSDI, but that stopped after going back to work

- Individual Monthly Income Limit: $4,132

- Married Couple Monthly Income Limit: $5,572

- Resource (asset) Limit: $4,000/single or $6,000/couple

- Program Covers: Part A premiums only

- Don’t confuse QDWI with other state buy-in programs like 250% Working Disabled.

Understanding the “Plus” or “Only” Factors:

Some QMB and SLMB individuals may be referred to as “plus” or “only” after the MSP name:

- “plus” = individual has full-scope Medicaid (in addition to the MSP)

- “only” = individuals are ineligible for full-scope Medicaid (only have the MSP)

2

2

Enrolling in a Medicare Savings Program

Because MSPs are part of Medicaid, individuals will be automatically screened when applying for any Medicaid program. In some cases, individuals are automatically enrolled in a MSP when applying for Medicaid. If not, individuals can apply through the state Medicaid agency. Each state has its own application and in most cases for QMBs, individuals are enrolled one month after being determined eligible for a MSP. For SLMB and QI, benefits may kick in up to three months after being approved.

A Note on Improper Billing

Under federal law, Qualified Medicare Beneficiaries (QMBs) cannot be billed for Medicare cost-sharing (co-payments, deductibles, etc.). These amounts should be paid for by Medicaid when enrolled in a QMB program. If you or someone you know has been improperly billed for cost-sharing, call 1-800-MEDICARE. You can also visit the Improper Billing Toolkit from Justice in Aging.

3

Medicare is a vital program to many individuals, but unfortunately one that many people have trouble affording. Becoming informed about the Medicare Savings Programs could be the bridge you need to affordable healthcare and getting the help you need.

_________________________

- Center for Medicaid and Medicare Services. “2018 Medicare Savings Program (MSP) Income Limits.” Cms.gov. April 2018. Accessed 15 May 2018.

- “Medicare patients,” (Nov. 2, 2017), available atctmirror.org/2017/11/02/ct-budget-cuts-program-that-helps-low-income-and-disabled-medicare-patients. See also Public Act 17-2, Section 50.

- Burke, Georgia. Chan, Denny. Justice in Aging. “Medicare Savings Programs,” National Center on Law & Elder Rights. Webinar. 13 December 2017. https://vimeo.com/247331689?eType=EmailBlastContent&eId=4fa2be0d-cbd3-45ec-9674-88b6c3cc72cbAccessed 15 May 2018.