Expanded Medicaid:

These states have expanded access to Medicaid under the ACA, providing coverage for people with household incomes up to 138% of the federal poverty level: AK, AR, AZ, CA, CO, CT, DC, DE, HI, IA, ID, IL, IN, KY, LA, MA, MD, ME, MI, MN, MO, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SD, UT, VA, VT, WA, WV.

If you live in a state with expanded Medicaid:

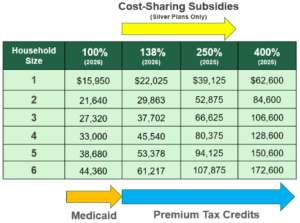

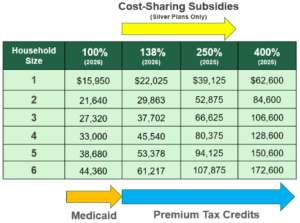

- Household income up to 138% of the federal poverty level (FPL): You have access to Medicaid.

- Household income between 138-250% FPL: You have access to premium tax credits and cost-sharing subsidies (if you pick a silver health insurance plan).

- Household income under 150% FPL: You are eligible for a Marketplace plan for less than $10 per month.

- Household income between 250-400% FPL: You have access to premium tax credits.

If you live in a state without expanded Medicaid (AL, FL, GA, KS, MS, SC, TN, TX, WI, WY):

- Household income between 100- 138% FPL: You have access to cost-sharing subsidies (silver plans only).

- Household income between 138- 250% FPL: You have access to premium tax credits and cost-sharing subsidies (if you pick a silver health insurance plan).

- Household income between 250-400% FPL: You have access to premium tax credits.

Note: the FPL numbers for the current year are used to determine Medicaid eligibility. The FPL numbers for the previous year are used to determine Marketplace financial assistance.