21 Sep Moving and Medicaid: New State, New Rules

If you are moving to a new state and have Medicaid, you should plan ahead to avoid being left without health insurance coverage. In this blog, we’ll cover where to start, income eligibility, timing your move, and some examples of how this all works.

Medicaid is a federal program, but each state can have different Medicaid rules. This may mean that you can’t easily transfer your Medicaid coverage from one state to another state. Also, you can’t have Medicaid coverage in two states. However, if you plan ahead, you may be able to get Medicaid in a new state and avoid a gap in your coverage.

Where to Start When Moving to a New State

If you have Medicaid and are moving to a new state, your first step is to research Medicaid rules in the state you are moving to. Visit our State Resources to find the contact information for Medicaid in your state.

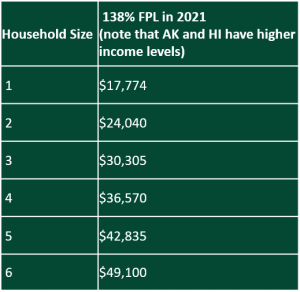

It is important to find out if your new state offers “Expanded Medicaid,” which may make it easier to qualify for Medicaid, because it is available to adults under 65, with a household income up to 138% of the Federal Poverty Level. Minnesota and New York give individuals with a household income between 138-200% FPL access to Medicaid through the Basic Health Program.

You should also look to see how Medicaid benefits in your new state compare to your current benefits. For example, your new state may offer more or less optional benefits, such as dental coverage.

Income Eligibility for Medicaid

Medicaid eligibility may be based on your modified adjusted gross income (MAGI), if you are:

- 19 and 20 years old and living with your parents

- A childless adult between the ages of 19-64 years old, living in (or moving to) a state with Expanded Medicaid

- Eligible for the Family Planning Benefit Program

- Filing for a child who is younger than 19 years old

- The parent or caretaker of someone meeting these criteria

- A pregnant woman

To calculate your MAGI:

- Calculate your gross income. You can calculate your gross income (GI) by adding together your different forms of income, including your salary or wages, rental income, business income, farm income, unemployment, and alimony. You can also find this amount by checking line 7b of your IRS form 1040.

- Calculate your adjusted gross income. Next, you adjust your GI, by subtracting qualified deductions. This number is located on line 8b of IRS form 1040.

- Calculate your MAGI. Now, add foreign earned income and housing costs for qualified individuals, tax-exempt income, and monthly Social Security benefits.

See MAGI requirements for each state.

Timing Your Move

You should also consider the timing of your move. Most states end existing Medicaid coverage at the end of the month. This means that usually, the best way to prevent lapses in coverage is to move close to the end of the month, cancel your coverage in your original state, and immediately apply for coverage in your new state. On average, it takes 7 to 90 days for Medicaid applications to be processed by a state.

However, if you need care while waiting for approval, you can still use Medicaid coverage. Once you’ve been approved for coverage, in most states, you can apply for retroactive Medicaid coverage to help pay for services that you received up to three months before your application date. Note: Some states have dropped retroactive coverage (e.g., Arkansas, Arizona, Florida, Iowa, Indiana, Kentucky, New Hampshire). Learn more about retroactive Medicaid coverage here.

As always, it is important to talk to your health care team to let them know you are considering moving, as they may be able to help with the transfer of your medical care and your Medicaid coverage.

Moving and Medicaid Examples

Scenario 1

Let’s say you’re moving from California to Texas, and you want to know if you qualify for Medicaid in Texas, how to enroll, and when to cancel your current Medicaid coverage. You would like to move within the next month, and it is currently August of 2021. Let’s assume you are a 45-year-old adult dealing with a cancer diagnosis and earning $1,350 a month. You have $1,700 in savings.

You qualify for Medi-Cal, California’s Medicaid program, based on:

- Yearly income ($16,200), which puts you under California’s income requirement of up to 138% of the FPL (or $17,774).

- Assets, which are under the $2,000 limit.

Now you need to figure out if you qualify for Medicaid in Texas. You discover that Texas has not expanded Medicaid, but that because you have a disability you might be able to get Medicaid. Your assets are under the $2,000 limit. Unfortunately, the income limits for that Medicaid program in Texas are $794 a month. So, you make too much to qualify for Medicaid in Texas. You may want to consider looking at your health insurance options in the State Health Insurance Marketplace at HealthCare.gov. For more information, see Triage Cancer’s Quick Guide to Health Insurance Marketplaces.

Scenario 2

Now let’s imagine you’re moving from Texas to California. You discover that unlike Texas, California does have Expanded Medicaid available to individuals earning up to 138% of the FPL. You qualify for Medi-Cal, because your assets are under the $2,000 limit, and your yearly income ($16,200), is under 138% of the FPL (or $17,774).

If you decide to move to California, you should close out your Medicaid coverage in Texas at the end of the month, and file immediately in California after you move. Remember, you can file for retroactive Medicaid for care you receive up to three months before your move, so don’t pause treatment due to a temporary lapse in Medicaid coverage.

Moving can be stressful, even more so when it involves re-applying for Medicaid health insurance coverage. But Triage Cancer is here to help.

*Note: there is currently a federal proposal to make it easier for people to move with Medicaid health insurance coverage and to have Medicaid cover care that you receive across state lines. Stay tuned . . .

About Triage Cancer

Triage Cancer is a national, nonprofit providing free education to people diagnosed with cancer, advocates, caregivers, and health care professionals on cancer-related legal and practical issues. Through events, materials, and resources, Triage Cancer is dedicated to helping people move beyond diagnosis. For more information and resources on navigating health insurance, visit TriageCancer.org/HealthInsurance and CancerFinances.org.