Checklist: Medicare Initial Enrollment

This checklist is for people who are enrolling in Medicare for the first time.

This checklist is for people who are enrolling in Medicare for the first time.

Most people first qualify for Medicare when they turn 65. Others qualify earlier if they receive Social Security Disability Insurance (SSDI) benefits. Your Initial Enrollment Period (IEP) lasts for seven (7) months. It includes the 3 months before, the month of, and the 3 months after you first qualify for Medicare. If you’re turning 65, your IEP is the 7 months surrounding your birthday month. (If your birthday is on the first day of the month, your IEP starts one month earlier.) If you’re receiving SSDI, your IEP is the 7 months surrounding your 25th month of receiving benefits.

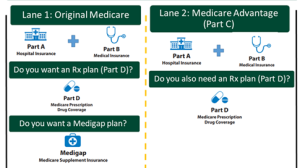

that a family member or friend make may not be the best choices for you. Do your best to make choices that cover the health care providers you want to see, and the medications you take, at prices you can afford. People with Medicare can generally choose coverage from one of the lanes shown below.

that a family member or friend make may not be the best choices for you. Do your best to make choices that cover the health care providers you want to see, and the medications you take, at prices you can afford. People with Medicare can generally choose coverage from one of the lanes shown below.For more information about Medicare and Initial Enrollment, check out our Medicare Resources: TriageCancer.org/Medicare

Updates: 01/2026

Disclaimer: This handout is intended to provide general information on the topics presented. It is provided with the understanding that Triage Cancer is not engaged in rendering any legal, medical, or professional services by its publication or distribution. Although this content was reviewed by a professional, it should not be used as a substitute for professional services. © Triage Cancer 2026

We're glad you find this resource helfpul! Please feel free to share it with your communities or to post a link on your organization's website. However, this content may not be reproduced, in whole or in part, without the express permission of Triage Cancer. Please email us at info@TriageCancer.org to request permission.

This Quick Guide can be downloaded and printed for free. If you are a health care professional, we provide free, bulk copies of many of our resources. To make a request, visit TriageCancer.org/MaterialRequest.