What Is the Medicare Prescription Payment Plan (MPPP)?

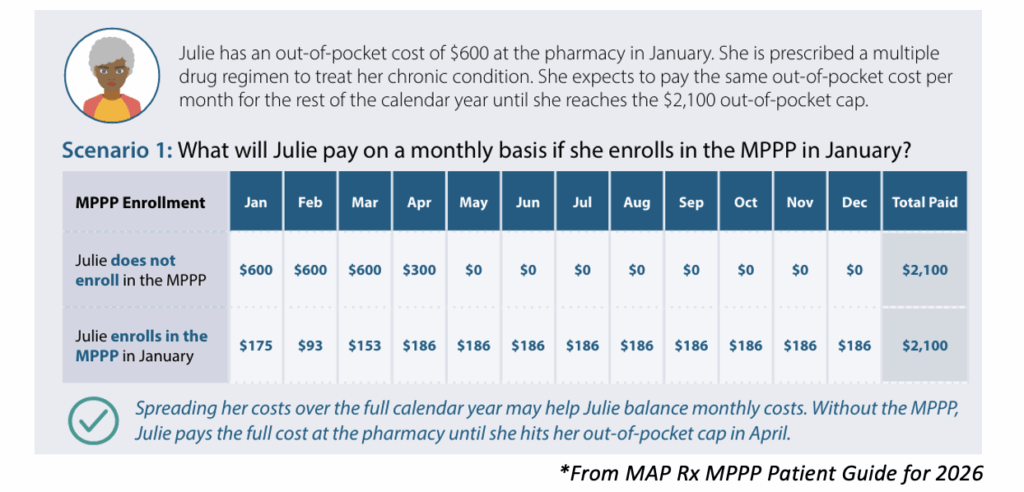

MPPP is a program that started January 1, 2025, that allows people with Medicare Part D coverage to pay their out-of-pocket (OOP) prescription drug costs in monthly installments instead of all at once at the pharmacy. This applies both to Medicare Part D plans and those who have Medicare Advantage Part C plans that include prescription drug coverage.

When an individual goes to the pharmacy to get their prescription drugs, they will pay $0. They will then get a monthly bill from their Part D or Part C plan specifically for the cost of their prescription drugs. This is different than your Part D or Part C plan monthly premium bill, which you will also get. Your Part C or Part D plan will pay the pharmacy for the cost of the drugs.

There is no interest charged on the payments when you are using the MPPP. You can pay the monthly payments by check, credit card, or debit card.

If you are late for a payment, your plan will send you a reminder notice within a couple of weeks after you miss payment. Your plan must allow you 2 months to make a missing payment. If you pay the bill during this time, you can continue in the MPPP. If you do not make the payment within the 2-month timeframe, your plan can remove you from the MPPP. Missing a MPPP payment will not impact your Part D or Part C plan coverage. The only way you can be removed from your Part D or Part C plan is if you do not pay your plan’s monthly premiums.

You can cancel your MPPP participation at any time, but if you decide to cancel, you must pay the balance of what is left on your payment plan for the year.