05 May Understanding Your Employment Rights: Covid-19 & Cancer

Triage Cancer recently offered a webinar on Key Changes to Insurance, Finances, & Work During COVID-19. Below are answers to some of the questions posed by attendees of the webinar. Note that Triage Cancer does not provide legal advice and the information below should not be used as a substitute for professional services.

We will be hosting another free webinar with the latest updates on May 14, 2020. Register here.

Please note that we also have a new module on COVID-19 at www.CancerFinances.org that includes information discussed on the webinar about loss of employer-sponsored health insurance coverage, new paid sick leave, new paid family leave, new unemployment benefits, and new cash assistance payments, including the charts shown on the slides.

Employment Questions

Do individuals diagnosed with cancer who have a weakened immune system and are at increased risk for infection from COVID-19, and are recommended to stay home by their doctor to avoid infection, would that person qualify for unemployment, short-term disability benefits, FMLA, or ADA?

First, it is important to consider what your goals are, before figuring out which laws, legal protections, and benefits might apply to your situation.

-

- ADA & Reasonable Accommodations: If your goal is to continue working, but want to figure out how to best protect yourself from infection, then you should identify if there are any potential reasonable accommodations that are available to you under the ADA or a state fair employment law.

- For example, a change in your workspace (e.g., telecommuting from home or working from a different location), is a potential reasonable accommodation. Most people going through cancer treatment have a compromised immune system, at least for a period of time. So, a request to telecommute for a period of time isn’t unusual. However, because of the uncertain nature of COVID-19 and how long it will take for things to play out, an indefinite request to telecommute may not be seen as a reasonable accommodation. Courts have found that attendance is an essential job function. But we are also in uncharted waters and the landscape is changing day by day.

- Other examples of accommodations include access to protective equipment or changes in job responsibilities.

- For information about accommodations, visit our Employment Resources We even have a five-minute animated video on managing side effects at work, which explains reasonable accommodations. And, for additional details on accommodations and tips on how to approach employers, we recommend the Job Accommodation Network (JAN) as a resource: www.askjan.org.

- ADA & Reasonable Accommodations: If your goal is to continue working, but want to figure out how to best protect yourself from infection, then you should identify if there are any potential reasonable accommodations that are available to you under the ADA or a state fair employment law.

2. FMLA & ADA: If your goal is to take time off work, there are a few options. The FMLA provides employees the ability to take time off for your own serious medical condition or as a caregiver of a spouse, parent, or child. However, your medical condition has to prevent you from being able to work. It is not enough to say that you fear getting infected from COVID-19. Your health care team can help you document any side effects from treatment, including your compromised immune system and explain why those side effects keep you from being unable to work.

-

- If you do not qualify for FMLA leave, but are eligible under the ADA, you may be able to take time off work as a reasonable accommodation under the ADA or state fair employment law.

- For more information about the FMLA, visit our Employment Resources

- Short-term Disability Benefits: If your goal is to take time off work, because you are unable to work due to a medical condition, short-term disability benefits can help you replace lost income. Benefits can be offered by your state, or through a private insurance company.

- Generally, in order to be eligible for short term disability benefits, your medical condition has to keep you from performing your job. Being immunocompromised is usually not enough to meet the requirements of being “unable to work,” because the potential risk of getting infected by itself, does not actually keep someone from being able to do their job. However, if individuals are experiencing side effects from treatment that have an impact on their ability to do their job, that should be explained in any application or appeal to a disability insurance company or state program. Members of their health care team can be helpful in providing supporting documentation of those side effects.

- Unemployment Benefits: If you lose your job or have a reduction in your hours, you may be eligible for unemployment benefits in your state, in addition to the new federal benefits. Deciding not to go to work because you fear being infected by COVID-19 does not qualify you for unemployment benefits, generally. However, some states may have broader eligibility rules for benefits.

- For example, the Governor of Michigan issued an Executive Order to allow people who have a compromised immune system to file for unemployment benefits.

- In addition, on April 30, the Texas Workforce Commission updated its rules to allow certain workers (e.g., those at high risk (age 65+) or a household member at high risk) to turn down available work, and still access unemployment benefits. Each case is reviewed on an individual basis.

Who pays for the sick leave – the employer or the government?

“Covered employers qualify for dollar-for-dollar reimbursement through tax credits for all qualifying wages paid under the FFCRA. Qualifying wages are those paid to an employee who takes leave under the Act for a qualifying reason, up to the appropriate per diem and aggregate payment caps. Applicable tax credits also extend to amounts paid or incurred to maintain health insurance coverage.” For more information, please see the Department of the Treasury’s website.

What's the rationale for excluding healthcare workers from the paid sick leave and FMLA leave?

The rationale is based on the idea that health care providers and emergency responders are essential employees and there is an increased need for them to be at work during a health-related crisis.

If you work for a large employer of several thousand employees, are you not eligible to take the paid FMLA leave to care for a child whose school is closed?

That is correct – the FFCRA does not apply to employees who work for an employer with more than 500 employees. However, if does not prevent an employer from offering this benefit to their employees.

Does the additional $600 per week unemployment insurance benefit include hairdressers?

The new federal unemployment assistance benefit does apply to independent contractors, free lancers, and gig workers.

However, here is some late breaking news. Last week we learned that if an independent contractor has had any W-2 income during the period of time they base your weekly benefits on, that is the total income amount that payments will be based on. It will not include any additional income that an individual receives during that period from non-W-2 employment. So for example, if a person works a project job with an employer as a W-2 employee for one month, but works the rest of the year as a free-lance photographer, the weekly benefit will only be based on the wages earned during the W-2 employment. This could potentially be a huge loss of employment benefits each week, but unfortunately it is the way that the federal law was written. This means that independent contracts in this position may only get their state’s minimum weekly benefit amount, plus the additional $600 from the federal government for four months.

Health Insurance Questions:

How do we get more information to help advocate for opening the health insurance Marketplaces in other states?

While some states that run their own Marketplaces have reopened to allow people to sign up for health insurance coverage, there are 32 states that use www.HealthCare.gov, which is run by the federal government. The President has announced that he will not reopen the Marketplace for those states. Triage Cancer joined organizations from across the country to ask the Administration to consider changing their position. For information on engaging in advocacy efforts, visit the Triage Cancer page on Advocacy. You can also contact your elected officials on Facebook and Twitter. To find your elected officials, visit: www.usa.gov/elected-officials.

When using the Marketplace, any suggestions for helping our patients estimate their 2020 income given the uncertainty of businesses opening up?

When you enter your household income for the Marketplace, you are supposed to estimate your income for the year. For someone who has recently lost their job, or been furloughed, you can estimate your annual income based on any earnings that you have received during the year so far, plus any potential unemployment benefits that you may be eligible for. The key is that it is an estimate. But, you can report income changes to the Marketplace throughout the year and they will adjust your financial assistance. This is helpful because if your income goes down during the year, you can report that change and they will increase your financial assistance. Note: if you are in a Medicaid Expansion state and you estimate income under $17,609 for the year, you will be directed to Medicaid in your state, rather than the Marketplace. Visit the Triage Cancer health insurance page for more information.

Does Triage Cancer offer a training/program for those who may becoming eligible for Medicare soon? (especially those under 65)

Yes! We have a recorded webinar on the Medicare Maze. We will also be hosting a free, live webinar on Understanding Medicare on September 15, 2020. Register at https://triagecancer.org/webinars. We also have Quick Guides on a variety of Medicare topics and information on health insurance at https://cancerfinances.org.

What are the health insurance options for those who are furloughed temporarily, but expected to return to work?

Some employers are maintaining health insurance for furloughed employees – I would suggest checking with employer. If not, then all of the same options would be available as if they were losing their jobs (e.g., COBRA, state-COBRA, SEP in Marketplace, etc.) More info on the Triage Cancer health insurance resource page.

What is the link for the drug coupon card you offer?

Here is the link to the FREE drug discount card that Triage Cancer offers in partnership with NeedyMeds: https://triagecancer.org/drugdiscount.

When you are shopping for health insurance coverage, how can you figure out if the plan will cover cancer-related drugs?

If you can’t find information on the plan’s formulary (list of covered drugs), then the best way to find out is to contact the insurance company directly. It is important to know that formularies are allowed to be changed during the year. That is why it’s important to understand how to get an exception if you need a drug that is not on the formulary. You can also appeal any denials of coverage.

Cash Assistance Questions

If a woman has a baby in 2020, will they get a $500 credit on next year's taxes? And, are recipients of the $1,200 assistance required to pay the money back (i.e., via taxes) in the future?

Yes, the woman would get the $500 for her child, however, she would not receive it until next year and it would be in the form of a tax credit. The reason for this is that the payment is based on the last tax filing, before she had the child. Furthermore, if someone has an income loss in 2020 “they may be able to claim an additional credit of the difference when the individual files their 2020 federal income tax return in Spring of 2021.”

Unless the individual commits fraud somewhere, the stimulus checks do not need to be repaid.

How do these cash payments affect the government programs that someone might be eligible for?

First, you do not have to pay income taxes on the cash assistance payments. Payments do not affect eligibility for Marketplace financial assistance, Medicaid eligibility, and Medicare Savings Programs. The cash assistance payments are also not counted as income for:

- SSI and payments are excluded from resources for 12 months; or

- SNAP, TANF, or federal housing purposes.

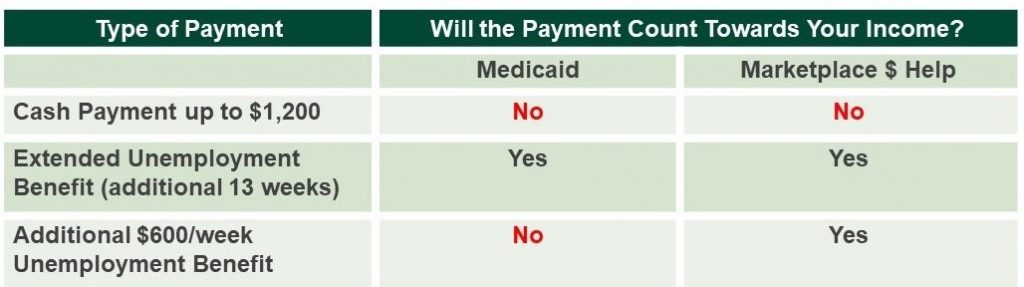

However, an increase in income from unemployment benefits may impact benefits:

For more information about cash assistance, visit CancerFinances.org. Click on COVID-19, then click on New Cash Assistance Payments.